Market maker thing went out after January run up and was debunked.

Keith is using an entirely different set of codes. Copy/paste from his notes:

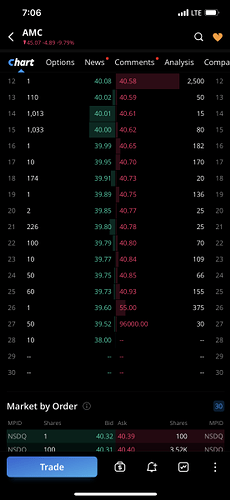

I’ll start out by what I called brackets. Take a look on the very top bid side.

At 40.08 there is a 1 share bid. Look down to 39.99 you see another 1 share bid. That’s the bracket

All the orders inside of that bracket will be hit by the price movement

The one is the code for the algorithm.

The numbers have a priority set to them.

Let’s find the other brackets and then we will go over the priority of each code

At 39.99 you still have the bid of 1 share so go down and we have 39.89 also a bracket of 1 . The number 1 is the highest priority from the market maker. You will see bids of 101, 111, 311, etc. You’re looking for the last.

The last # is the algorithms code.

So real quick look at the ask side to see which asks are inside of a bracket.

I’m sure every sees all the orders ending in 5

At 40.61 you have 15 shares. So we go down until we find the next ask ending in a 5. Which is 40.77 of 25 shares.

The other orders inside that bracket of 5s has a priority set to them.

They use just about every #0-9 as a code.

So to be clear a bracket could end in any number 1-9. I’ll explain the 0 by itself

Bids in a bracket priority. This is where buying and selling pressure comes from.

1= highest priority. Meaning as far as orders ending in it has greater pull to the side its on than the other numbers 2-9 that are also in brackets.

5= is the next priority with a very high pull to whatever side it has a bracket on

8 = is also a higher priority than 2,3,4,6,7,9

Here’s why you have only 1, 5, and 8 that has a higher priority than the other numbers.

222 is a code all by itself. Honestly don’t know exactly why it’s set apart but when you see it all by itself and no brackets on that side of the bid or ask. The price will always pull towards that 222 order

I have noticed that once it starts pulling the price to whatever side it’s on, eventually a bracket will form before the price reaches the 222.

4= not 100% sure but it stands alone most of the time ( not in a bracket). It has minor pull weight to it.

6= The easiest one. No bracket for it. This is your choppy pattern number. When the price movement runs sideways several orders ending in 6s will pop up right at the top on both sides. Bid and ask.

Here’s where the 0 comes into play. Once the market maker is finished trading sideways ( institutions loading thier boats) ( or unloading thier boats) you will see a bracket of only 10 shares. Inside that bracket of 10s is normally a larger order and it is 100% the price will shoot to the price inside those 10s. It could take an hour but it is 100% it will go to that price inside the 10s. The only exception to any of these brackets is if one of the numbers change all of a sudden. Most of the time it will flip again to the same bracket but I consider it the same as I would a broken pattern.

So we have the 7 and 9 left. I’m not 100 % positive but pretty sure the 7. acts as a stop and also send orders to the darkpool. The 9 is to bring it back from the dark pool. And I know that just blew your top off. Lol.

So that is the basics and pretty much the whole process of order flow, volume surges, buying pressure and selling pressure. I will next break it down a little more condensed. But you must know, understand, and remember what 0 through 9 mean.

Simplified. Start out watching for the bids and asks on each side of the order flow ending in a 6. 126 has higher pull up or down than 226 or 326 etc. This is the choppy pattern where stock only raises and drops around .10 cents per say. It shows a next move coming when a bracket forms on either side. Look down both sides of the whole order flow and see if you see anything in brackets of 5s or 10s. Remember on the 10s that it will go to that price. If it’s way down on the list it usually goes there at some point in the day if those numbers remain. You will see the 6s pop up again. Then the the price will head in that direction.