I’m also in this with some SPY puts, exp 7/28. I picked up 430P when model dipped toward impending ZOW. I gave myself a few days more, as I have missed on model’s predictions before. I’m pulling for all of us and I want to gain some confidence in this model’s output. I’m not upset, it’s my own trade. But, I do need to learn how to use the model’s predictions with some other TA. I am not comfortable using it without some deeper understanding (aka “secret sauce”), or a corroborative TA metric. Elliot waves? Options burned me a few times with this model.

I am getting kicked around, as well. I was pretty confident at the exuberance of the prediction and it did roll a bit. My confidence has waned, though and hope is not a trading metric for me. Best of luck to you- pulling for a dip.

I went a little heavy too early. I actually zoomed out last night and looked at the daily and should have waited. We actually went up and hit resistance and I bought way too early because I didn’t bother to look at the chart. I have defiantly had more green days with Jim’s model for commodities than red but this one hurts. Still trying to fine tune his info with my entries and exits.

This is exactly how I feel. I’ve been throwing myself into this program for the last few weeks and that AMC call and this SPY put were the only calls I can remember him making. I took both and have been burned twice. I really want to believe in this but my confidence is slipping for sure

Pre market is showing the price up damn near $5 OVER the strike for the puts I bought. Again, I didn’t bet huge on this but, how do we retain any confidence in the model when it’s this wrong? I would have been better off to just do the direct opposite and buy calls.

My timing was also off- I rushed it, abandoning good reason. Moving forward, I’ll couple the sentiment from BAM model with patience and TA to corroborate. Trust, but verify moving forward. I do feel the model is correct and it quantifies SPY strength on a few big tech names, while rest of SPY is weak- feels hollow to me. But, alas, my entires and exits were poor- that’s on me.

At the end of the day the model is another “tool”…another arrow for your quiver if you will. I will still place some small “bets” based on some of the info but definitely need to work on my patience and make sure that I do my part before making an entry. In hindsight I’m still in kindergarten when it comes to all this.

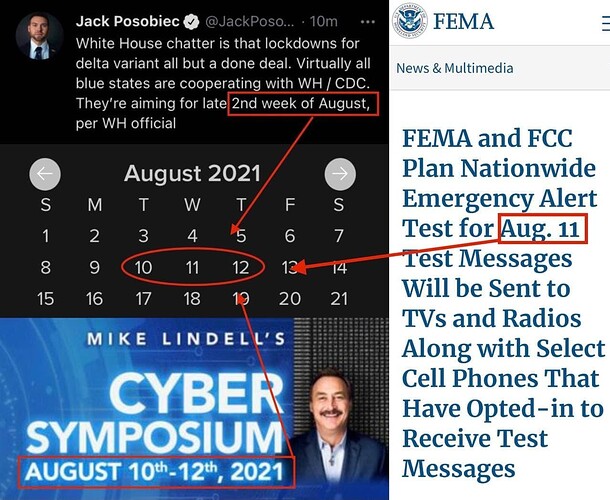

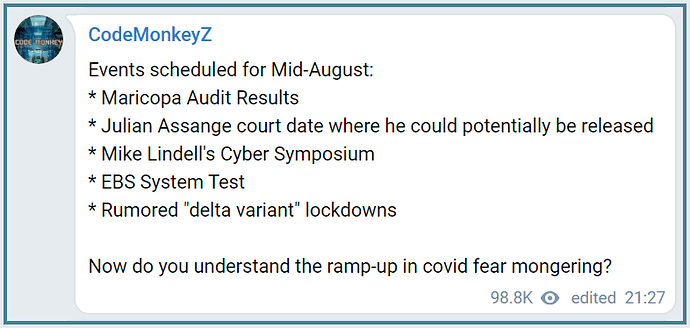

Take it as you want but this lines up with BAM’s crash window. If they bring back lockdowns that would be the catalyst. Personally i would buy puts a little further out in case things get delayed because the people are catching on.

I don’t personally think it’s related to the Cyber Symposium but it is interesting if it does happen on those dates. Dominion is suing him for 1.3 billion for saying their machines were apart of the voting fraud and he is inviting all the politicians and news channels to watch his symposium where he will present his data on the election fraud and is offering $5 million to anyone who can prove his data is wrong. The news channels have refused to air his ads about the Cyber Symposium so people don’t know about it. So the person who made the picture is speculating they will start the lockdowns early to bury his symposium.

I was really hoping to see s&p futures down. I guess we will see what tomorrow brings?