I am seeing some very BEARISH impulse waves here in the S&P. This is either a big mid month market correction or we will see in the near future a Bear market starting to play out. Stay viglant guys!!

The DOC is ready. I have shorted every market index know to man!!! Thanks

EWT is showing some very bearish impulses especially in the US500. Currently taking some well earned leave and have spent the morning watching and trading the us500 live chart. Very clean bearish impulses, the us100 (nasdaq) not so, a little more messier. We shall see if this is a normal mid month correction process play out or wether it can turn into something more bearish. There is now a fib1.61 ext at exactly 4400.8 which i had previously worked out and it has played that way. i will be going short again at 4400 approx. I expect the bulls will trade through that extreme gap down. However, if we goes back to my other shorts at around 4450 soon then my count is wrong. We shall see if this establishes into something a bit more than a monthly correction.

Oh and currently I am long up to 4400. However, i have long term shorts that i have had in place since around the 4444 mark and above that. I will not close them longer term shorts as I believe we are on the precipice of a long term market correction. These ATH’s that keep coming are not sustainable long term. No one knows, but you can give it your best guess. However, correction is inevitable. Best bull runs come in a bear market. You will see violent, fast moves to the upside, quickly followed by lower lows. Finger on the pulse at all times. However, exciting times!

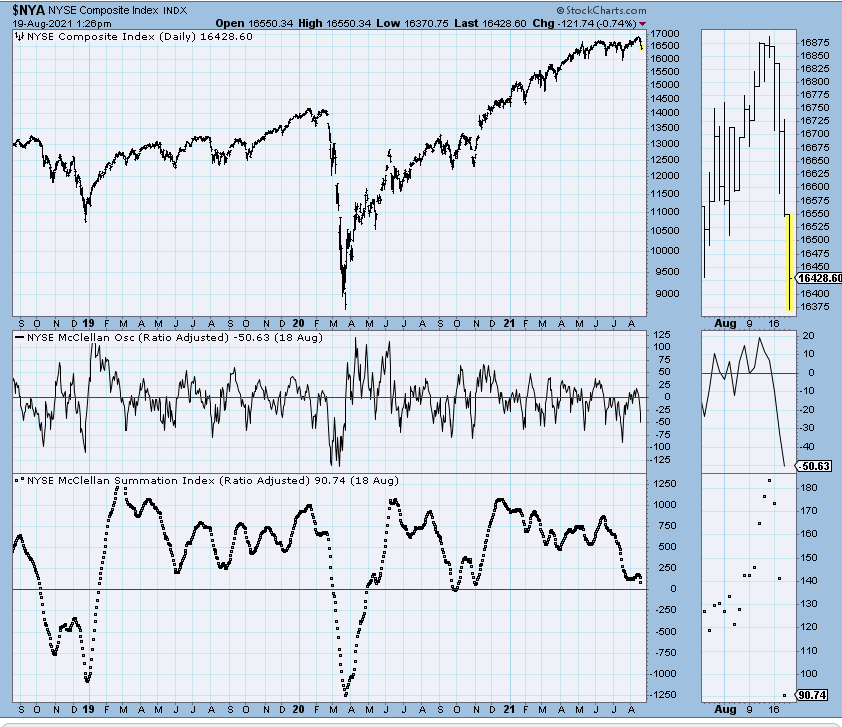

The ability of plunge protection types to pretend and extend is certainly impressive. I have been watching the McClellan Summation index arrest and resume its decline. Things certainly do look like they are headed south. Intraday, things have gotten pretty oversold.

If there is an ugly ugly crash like what happened in 2020 with negative oil, I am looking to load up on various oil/gas companies. If someone wants to give ET and USAC away, I will be a buyer.

A crash would possibly create a market correction that is long over due. The correction would be a big big one on a grand super cycle scale. If it happens we in our life times may never see a new ATH in these in these major index funds again. That is the one I have been waiting in trepidation to come. It is over due. We shall see. S&P has not broke through 4418 which was the limit of breaking a very bearish impulse wave. It has bounced off it and now headed slowly down. So the bearish impulse wave i see is still apparent ready to play out wave 5. The next move will be to below -------->4352. This will complete the wave 5. then an upward correction, that i already have a price for but keeping that to myself until i definitely know this wave structure stays intact.

If we drop then we possibly see the bearish wave 5 hit around 4313. That would be a nice bounce price.

Anyone else hoping the S&P can carry on this bearish trend it is on?

screw trend, i’m hoping for an all out crash

fair play. If the S&P cannot get above 4420. it may look that way.

fair play. If the S&P cannot get above 4420. it may look that way.

THanks guys for the commentary…I guess one value on the subscription is getting access to this forum and having you guys share information etc… with a lot of other predictions being a off, i’m really hoping the stair step cascade down prediction from BAM is correct,

S&P having a little rally. Smells like 2008 to me. Midweek sell off, rally thursday/friday…Then dump hahaha…Just need the dump

Well all bearish impulses were gone when the 4420 price got broke IMHO. I think we have seen another mid month option sell off. Now they’re all buying up again. Same as the past previous months. You just never know though. Gambling can be a problem remeber that guys!