want to know whats the theory behind market crash that can benefit amc?

its thought that as the market is crashing the shorts will eventually get margin called. If they get margin called they would be forced to close out their amc short positions, thus sending the share price up as the whole market goes down.

Im sure someone on here can articulate it better then i have. Im just an idiot from reddit.

If the markets are in a global macro event and shorts positions become too much of a risk to hold this will begin margin calls. They would have to cover in order to deal with the other positions in their portfolios. (someone correct me if I’m off)

If the market is reversing, having it happen the same time crypto is getting hammered is a thing of beauty for the margin theory.

I’m under the impression of what was mentioned is a factor in addition the the AMC having a negative beta. Which in theory should act as the opposite of the market, I’m not sure how that gets started but there seems to be a period before the disconnect occurs.

Chinas market has been closed this week until Wednesday. I am sure when that kicks in we will see some ridiculous ripple effects. Black rock is invested in them and they have over 300 billion in debts. I think their first payment of 87 mill is thursday or friday and a 2nd one around 23 mill soon after.

correct. An interest payment is due thursday and again next wednesday. Not sure of the amounts but i’ve seen numbers as high as $1 trilly in total due by EOY or something.

hopefully this theory is true. diamond hand AMC. trust in Jim!

look at AMC yesterday though…market was down and AMC went down with it…

I had a hard time staying focused at work today after seeing that.

still lots of news on the board for the week. Let’s see if any of it can make us some money.

For what it’s worth, my team’s strategy is showing all this to NOT be indicative of the crash we’re all awaiting. I’ve made a handful of calls/suggestions in the past in these threads and they’ve all come to fruition, but take it with a grain of salt.

AMC and BB are still not showing enough strength for takeoff per our model, but rather they’re pretty neutral. This is actually very good…

Jim keeps referring to pay me later, kicking the can… no matter how you phrase it, he’s spot on as our model has shown also!

Very interesting, thanks for sharing. i’ve been reading a lot of article today with strategists at major finance firms stating this is no Lehman Brothers repeat. yes there might be a sell off but nothing of a crash scenario. So makes me wonder about the model and it showing the crash leg… about AMC and BB, volume / velocity is what makes it go and I still can’t see what would trigger this. I’m sure a lot of people have lost interest in AMC and moved onto other trades, so this would require something to spark the volume.

Are you able to elaborate on why being neutral is good?

Nothing I say or have said is financial advice, simply interpretation and educational

From what we see - and from what Jim sees - there will very likely be a very significant crash. I made a post a while back on Occam’s Razor; if you’re unfamiliar with that I suggest familiarizing yourself with it. In short, firms purposefully try to get so big and become so highly leveraged they become quite literally too big to fail. Lots of market factors will play into this…

In regard to us being neutral on these two, it’s very positive. Moreover, it is absolutely temporary. Think about it like this: would any old institutional investor tell you the fundamentals match the price or price targets? No. They’d say these are way overvalued. What does that mean for us to be neutral? These price levels are sustainable and our model is patiently waiting for a buy signal to generate.

I hope that makes more sense. If not, let me know and I will explain differently

Thanks very much. okay yes i understand much better now.

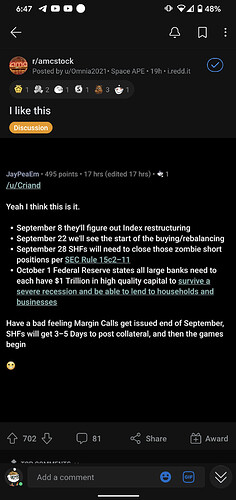

Thanks for sharing. One thing i don’t get is that if we can see these dates coming up, surely all the hedgies and banks can as well. Why would they not be adjusting at this point?