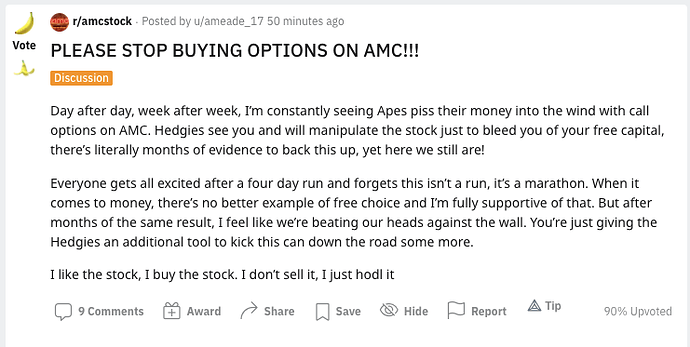

no options = no gamma

there is and will never be a gamma squeeze. The squeeze will be organic.

Sorry Beach…disagree.

There was defiantly some gamma going on for that run up in June.

Organic squeeze? You referring to external market conditions being the only possible catalyst?

There was a gamma squeeze in June. Options are a necessary evil. Without them, there is no organic squeeze either. Too many shares.

oh, i totally agree but those days are over. They have complete control of this and will not let it get loose again.

I really don’t think people understand how systemic the corruption is. I just read a post on here about how crude is rigged.

Volume is dried up. Retail is tapped out. Not buying options is just a PSA on just letting it all unfold and not trying to force it.

You guys be you. Buy the ■■■■ out of options.

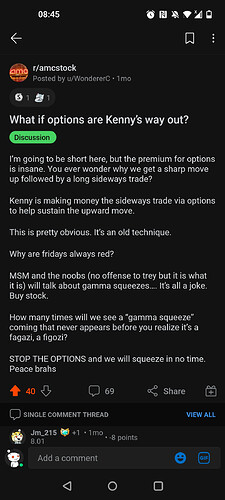

It doesn’t take that much to get it going again. It just needs to start early in the week causing the MM’s to Delta hedge.

my friends like to say, Beach, please. haha

I get it bro but I’m not a fan of Reddit.

Its not rocket science. How many people have sold since the 60’s or 50’s…a ton.

What do you think is going to happen if this starts to run again…especially in the beginning of the week.

Delta turns into Gamma turns into FOMO…etc…wash, rinse, repeat.

I understand the whole thing. I’m just saying another run up can happen easily if it gets ignited early in the week.

100% agree. However, we’ve seen too many tricks and been burned too many times to fall for it. Stock is the answer. When this thing rips, premiums will skyrocket along with it so the only safe options bet are far, far out, IMO.

I mean look at today. BAM was SO confident (hell maybe he’s just doing it bleed with us) it is going to 35 he bought in. Look at what’s going on… 32.20.

We’re trying to flank and attack from below when really the battle is won from the front. Honestly, no one has a clue. Hell, i dunno. maybe i’ll go buy some options.

Yeah I’m not referring to weeklies. Especially on a Friday. Total gamble.

But as a example I have some 42’s from last month. If Monday starts of strong and those 40’s, 45’s and 50’s look like there going to expire in the money then Delta hedging should start Tuesday or Wednesday depending. Then if that momentum keeps up we should see the options payoff.

when do they expire?

8/27

stupid bot word salad

hahah yes, bad bot.

I’m going out on a limb here but ain’t NO way your 42s are going ITM. Why do i say that? i, too, am holding calls i bought almost 2 months ago that expire on the 27th. $12k right down the pisser. Add to those my other options that have already expired worthless, roughly $8k, and what you have there is one expensive lesson. All based on BAM’s model.

Now, don’t cry for me argentina, I got LUCKY with a few AMC options plays months back, AND just happened to be holding $40c with a few weeks left to expiry when this hit 72, ALL before finding bam.

With some nice footing to really invest, I wanted to ensure I did so smartly. Bought the Global Pro membership and readied myself for success. You don’t need to guess where we landed or how this ends.

i’ll also add that ain’t NO EFFING WAY this thing gets anywhere near 35 today.

The majority of my calls bought were pre run up…on purpose.

I bought those 42’s based of off ZOS predictions. I’ve since stopped that.

I used the same strategy with BB. bought a ton of options with far out expiration and I’m done buying options on BB. No matter what happens during.

I still have hope for the 42. Just need to kick the week off right. I had one earlier in the week (don’t remember the strike) that was a yolo ZOS from last month that broke even and I sold immediately. it was in the red for about a month. like negative thousand dollars red.

yes, i think the best any of us can do now with regard to options is just buy WAY out (dare i even say next year?) so that when that first misstep happens, and the hedgies start to fold, we just collect the cash. Forget price strategy. Focus on time.

And i have $500 in BB options expiring worthless today. I still have my Sept 17s in play, but my faith is shaken.

Bro…

No I stopped following the zones closely a little bit ago after losing a decent amount of profit. Now I push out past the last ZOS or break them up but still past the prediction.

For example I have 11/19 DIA and a 1/22 SDOW. Yeah way past and more expensive and possible not the best return but the safety is way more worth it. Forecast calls for weakness 9/20 and into December so I went well past that.

Not financial advice not a finance advisor…lol