First I would like to say the BAM system has worked well for me. Even though AMC has been in a down trend for the month of July, we can still make money trading on the BAM system zones of strength and weakness. Personally, I prefer options trading using deep in the money options with an expiration of 2 to 4 weeks out… Just a safer play IMO. I also own the stock but sold enough a couple of weeks back to get my original investment back and now I am a holder of my remaining shares until the BAM system says the stock has topped out.

Trying to follow this. So like today looking at the 43 - 32 channel. Buy the option as the price dips through the day?

I’m still brand new and trying to understand, but I thought right now with the $38 dip that a $54 8/6 call. OR should I be looking at this like $38 call for 8/6 for a safer trade?

Not taking your response as advice just knowledge

I would just be cautious buying call options for August if you believe there will still be dips in July. You’ll be battling Delta on the dips and Theta decay. One thing you could do is use X % of your option play to enter a position, leaving X % to average down if there are more dips or to combat natural theta decay. Up to you though, NFA

Dude, AMC has just broken down through the 40 dollar support line. This is a very bearish signal IMHO. I think we should be seeing the low 30s very soon, possibilty to break down to around the $25 mark as well. That is just my opinion, but i big support line has been broken through.

That’s another major thing I have to learn to is scaling in and out.

Thanks for taking the time, my experience has been more like fortune telling thus far. A simple, Ok I think its going to this point. Then buy way out of the money puts or calls eye balling that price point. Like a couple weeks back when Nike gapped up, I took out puts with the thought that the gap would close within the coming weeks. I was wrong

Were projected around the 30 mark give or take. Waiting and watching to drop another bag on it for the ride back up.

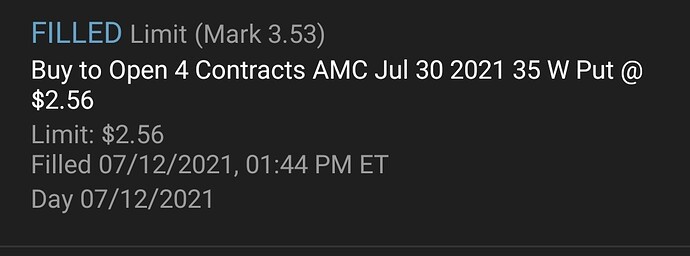

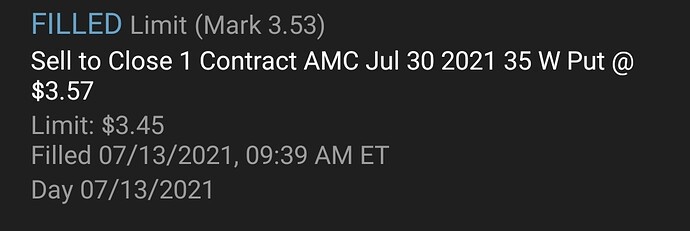

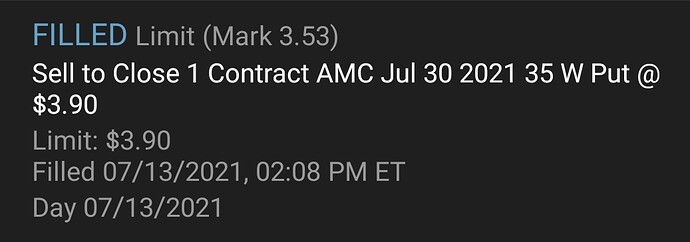

Long AMC but have been playing a quick in and out on puts and seemed to be rewarding with the ZOW however just my strategy and will probably stop when my gtc limit order hits…this is a very risky play I have been doing so please do your research and I am Not a financial advisor and this is not financial advise. I am saying it has been working for me. Like Tesla Yesterday, bought 680 and 670 puts sold today and made money. It can make you money or lose you money in the blink of an eye. So please enter at your own risk! So there is money to be made even when it goes down. Like I said I am long with shares and buying dips

Since your looking further out for your expiration there’s 2 things to keep in mind. 1st we are going to retest that $33 level either tomorrow or the 15th. The hedge funds have a lot of puts that are out of the money so they are working hard in the dark pools to short AMC down. So I would wait for the $33 level. Second J, stated that we’ll be retesting the $47 support by the 22nd. So I would by a call for the $45 strike for the 8/6. Once we hit the 22nd he stated that we would be going back into a zow by the 26th. So sell that call by the 22nd and then wait for that low to happen and then rebuy your calls using the profit.

I hope this helps. Also use option profit calculator and you’ll be able to see how much you’ll be making on your calls and puts.

1 more thing I like to do to keep myself out of trouble. I keep a good amount of shares so that if my options don’t work I’ll still have my shares to ride up when the squeeze happens.

Thinking about Jim’s last video of multiple strong ZOS in August, Thanksgiving-ish and February. Didn’t BAM generate another Melt Up line so we have 2 going now? Would it be probable that we could touch both in the next 7 months?

Lol I think we are on the same page!

I just closed my puts at $35, then bought 137 calls for 6 august $50 strike. I think we saw the low for today. I’m hoping Jim will say this was the july low and we can skip the 26th

We’ll I guess I should’ve listened to Jim, I sold my puts to early and bought my calls to early. Should’ve kept holding till 33. Whatever at least I’m set up for the ride back up

Thanks.!

I wasn’t going to enter anything today, was just asking as a “how do you do it” / “Whats your strategy when trading options looking at what we are facing now”.

Will pull up an option calculator tonight and play around with it.

Thanks again.

My strategy is simple, I always buy a few weeks out at the price of the stock unless Jim forecast a big move. Like today I sold my puts and bought calls for 6 August with a 50 strike. I bought the 50 strike because Jim said we’ll see $49 by the 22nd. When I sell those calls I’ll rebuy calls for a later date at the price of the stock. I like to buy 10 -100 calls at a time because that gives me control over 1k shares or 10k shares.

I hold all my shares in my Roth IRA

Bought a lottery 41 calls for Friday

Holding 3000 amc stock since 5.50

I’ll be the one to say it. Why is Jim waiting again until after the bounce to give us an update? How about sharing any ZOS like other days? I would like some guidance during these volatile moments, not just a recap after it is recovering.

Probably he doesn’t have the data

He said low today midday. Then upward into 15-16th

Jim said low in afternoon trading

Is that afternoon pst or est? I’m assuming pst, but assuming is not a good habit either.

They do not trade in the afternoon for PST.