How many times can you kick a can before there is no can left to kick,

I just wanted to share that with you.

When I read the M&A deals records, it reminds me 2007.

What do you think?

It could be nice to have Jim’s thoughts on this one. /cc @jgsavoldi

I don’t want to enter too much into the consipracy field but as an ex-investment banker working in M&A, I am pretty sure Managing partners worked hard last year and this year on deals when prices are at an ATH to eat massive fees.

We know what happen after that in 2007…

I also remember before the 2008 market crash, bonuses were at ATH…

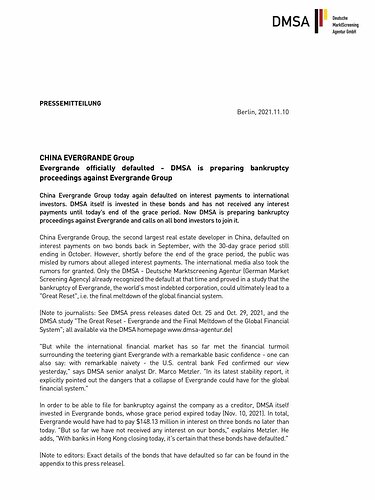

Interesting information that might have not have seen in mainstream media.

“no apparent reason.” hahaha sure, china.

CCP: “Nothing to see here!” Nothing at all!"

suuuuuuuuuure

The current game of chess they are playing amazes me.

you know, no different than our gov who continually bullshits everyone about inflation, how the market is great, etc. Fuckers.

Good read, thanks for sharing.

helluva find @cheeseburgerbill. Let’s see if it actually moves a needle or if everyone continues pretending “there’s nothing to see.”

m

I’m going to bet on the continuation of “nothing to see here.”

One of my favorite sayings in recent times from Jim on Twitter a couple days ago. “The wheels on the clown car are starting to wobble.”

i’ll give jim this, that’s a funny a$$ expression - clown car wheels a-wobblin’.

Between Evergrande, DIDI and Taiwan China is starting to look very desperate.

That makes me worried.

Oh boy