So I’ve finally completely wrapped my head around this.

They short to the point that the stock is delisted from the exchange. Once on the OTC market they can basically beat it into oblivion due to less people buying the stock and basically nobody watches the pink sheet stocks. The profits they are making are unrealized gains but they are applied to their margin so they are able to show it as an “asset” and use it as such. Their hope is the company goes bankrupt and then they won’t pay the taxes on the gains since they never closed out the position. If they close the position out prior to bankruptcy they would have to pay on those actual profits.

If they are bleeding somewhere (AMC/GME) else they will close out some of their positions to try and help manage the other stock that they are loosing control of. That zombie stock will run up as they close those shorts (look at Sears and Blockbuster during the Jan GME run up)

I think AMC started basically as a run up due to them having to close some shorts as GME ran. GME was the start and where they got their hand caught in the cookie jar but as they had to close other shorts to cover the bleeding we saw the pop and dove in. Now they can’t get us out.

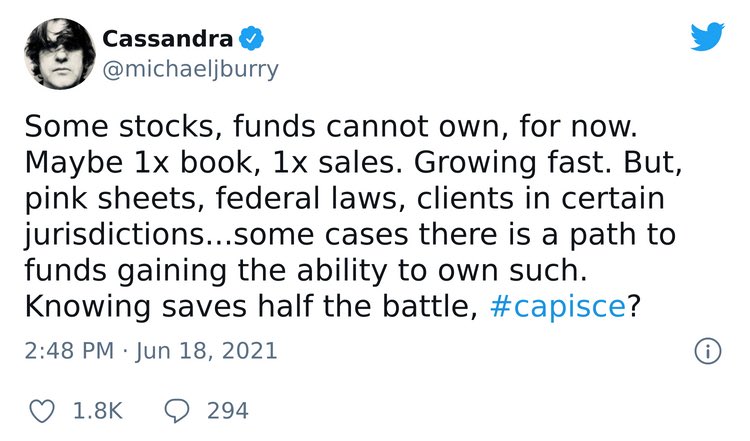

That 1800% run on Blockbuster yesterday must have been SUPER painful for them. This makes sense why they are trying to put regs into place to reduce buying of OTC stocks. If retail figures out that those super cheap stocks were heavily shorted we would buy the crap out of them (and kinda just did).